Salary increase budgets for 2023 are a good news-bad news scenario. Good news for employees, bad — or perhaps more appropriate, not as good — news for employers. However, that may be up for discussion.

Rising inflation, tough competition for talent, and retention challenges are causing employers to assess how they will meet strategic objectives. One way is more effectively using and continually reevaluating their total rewards budgets, which are rising to levels not seen in more than 20 years.

Here are some numbers to consider:

-

BDO USA’s 2022 Salary Increase Budget Pulse Survey showed average compensation budgets increased by 4.4% overall and 4.6% at for-profit organizations. BDO, a provider of assurance, tax, and financial advisory services, also found that nearly half of the surveyed organizations recently raised their salary increase budgets, and their average is 5.1% overall and 5.4% at for-profit organizations.

-

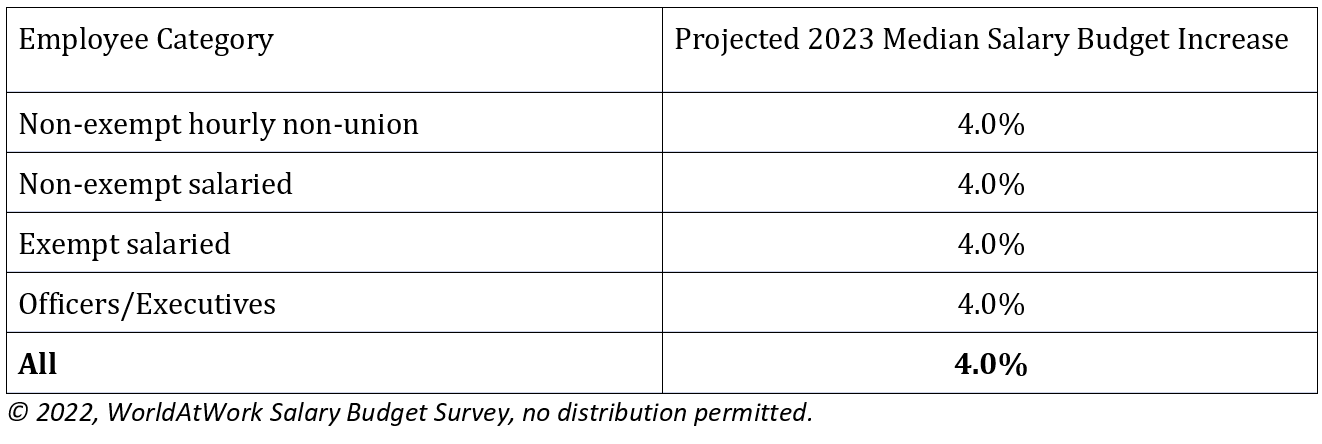

The 2023 numbers look similar. According to the WorldatWork Salary Budget Survey 2022-2023, published in July 2022, U.S. entities are projecting median increases as shown in the table below:

-

Employers Council’s 2022 Planning Packet Survey (2023 Pay Increase Projections) shows numbers across a four-state region. For the “average/typical” employee, employers are projecting pay increases of 4.6% in Arizona, 4.3% in Colorado, 4.2% in Utah, and 3.7% in Wyoming. For “top performers,” the figures rise to 5.3% in Arizona, 6.8% in Colorado, 6.3% in Utah, and 6.4% in Wyoming.

-

According to the annual salary report by consulting firm WTW, formerly Willis Towers Watson, fewer than half of companies, 45%, are sticking with the pay budgets they set at the start of the year, which is out of the norm.

Let’s do a quick primer on the Consumer Price Index (CPI) and Cost of Living Allowance/Adjustment (COLA), which we hear a lot about at salary planning time, and the Employment Cost Index (ECI), which we hear far less about.

The CPI measures price change. It’s about inflation, or what stuff costs to buy. The CPI is a “basket of goods” that consumers buy regularly and others they do not (e.g., cars and houses). It is not a cost-of-living measure for an individual consumer. The CPI is a reference point for employees and employers related to inflation. The CPI-U is most often tracked as it includes a larger group of people: all urban consumers, equating to 80% of wage earners. The CPI-W is often used as a reference with collective bargaining units because this survey measures more positions requiring physical labor or a trade.

A cost-of-living index is a theoretical price index measuring the cost of achieving a certain standard of living in one year relative to the same level the next year. Standard of living is not directly measurable; therefore, it is a theoretical ideal. COLAs were originally intended to keep employees' purchasing power the same in times of high inflation. Once given, they are hard to remove after the economy stabilizes.

The ECI is important because it measures the changes in the cost of labor. Directly employment-related and essential for total rewards planning purposes, the index:

-

Looks at what people are paid.

-

Serves as an indicator to gauge how salaries are moving the market.

-

Tracks increases in the cost of total compensation (salaries, bonuses, incentives, commissions, and lump-sum payments quarterly).

-

Allows organizations to compare to others regarding rising or decreasing employment costs.

-

Is good during normal inflationary times.

You can find the CPI and ECI measures on the U.S. Bureau of Labor Statistics website under Major Economic Indicators.

Companies are also looking at their total rewards budgets to strategically address attracting and retaining employees. Employers are very concerned about rising inflation and are offering, where possible:

-

Flexible work hours

-

Remote work

-

Market adjustments/increases to base salary

-

Providing additional training/development opportunities

-

Focusing retention efforts on hard-to-fill positions

-

Not passing on increases to health insurance premiums

-

Retention and/or sign-on bonuses

-

Short- and long-term incentives

Be creative in your use of these tools and measures, while keeping in mind the organization’s ability to pay. Employees looking forward to huge raises must remember their pay may be dependent on many factors, such as job performance, results/contributions, and responsibilities, along with the organization’s ability to pay.

Best wishes for implementing a successful strategy and negotiating your total rewards budget/package for 2023. If you have questions or want more information, please email the Employers Council Member Experience Team.

#CompensationPlanning#EmployeeRetention#WorkforcePlanning