The 2022 Health, Welfare & Retirement Plans Survey includes responses from 536 participants across Arizona, Colorado, Utah, and Wyoming. The respondents represent a cross-section of industries and employment sizes.

The survey includes data on health and dental coverage, life insurance, retiree coverage, short-term disability, long-term disability, accidental death and dismemberment, retirement plans, wellness programs, and part-time employee benefits. The data are displayed by geographic breakouts, organization employment size, and industry type.

Health Care Costs

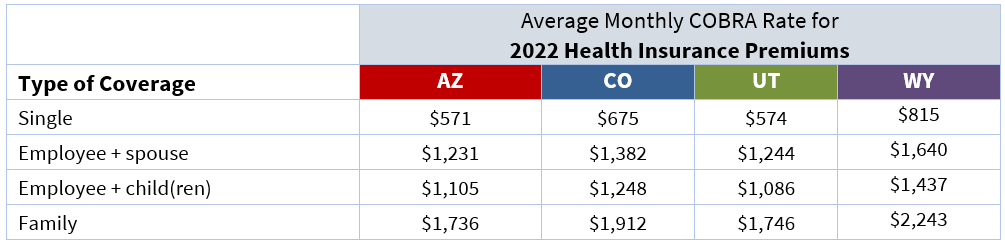

Data from the survey show the average monthly COBRA rate for coverage is:

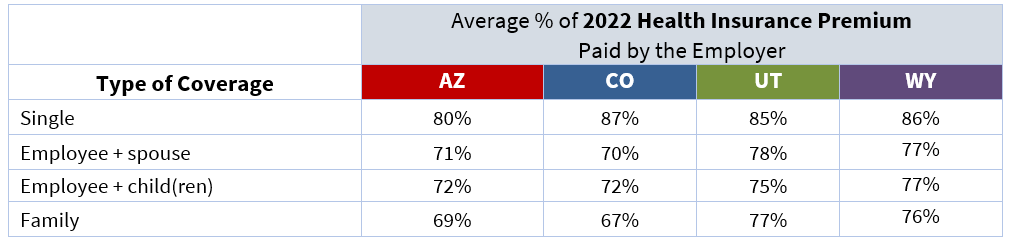

The average percent of health coverage paid by the employer is:

How popular are high-deductible health plans (HDHP) in employers’ health insurance options? According to the survey, HDHPs are offered by 76% of respondents in Arizona, 58% in Colorado, 86% in Utah, and 70% in Wyoming. Of the respondents, 65% in Arizona, 60% in Colorado, 80% in Utah, and 83% in Wyoming are also offering a health savings account and/or a health reimbursement arrangement as an option for employees.

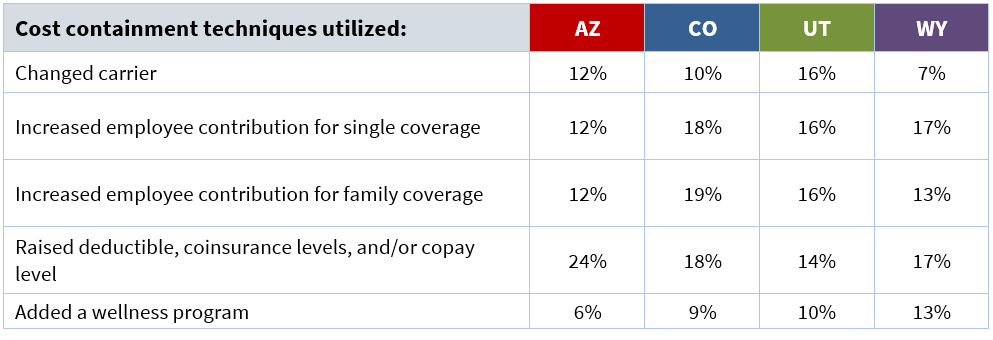

With the increasing cost of health insurance premiums, what cost containment techniques did organizations implement in 2022?

A premium increase at last renewal was reported by 59% of Arizona respondents, with an average increase of 6%; 64% of Colorado respondents, with an average increase of 7%; 51% of Utah respondents, with an average increase of 7%; and 63% of Wyoming respondents, with an average increase of 8%.

Access the 2022 Health, Welfare & Retirement Plans Survey with your Enterprise or Consulting membership. For questions or to purchase the survey contact the Employers Council Surveys Department at surveys@employerscouncil.org or 303-223-5490.

#CompensationPlanning#Benefits#HealthBenefits#RetirementBenefits